Should you hold cash during inflation?

Should I keep money in savings during inflation

You should save more during times of high inflation. When inflation is high, your money won't go as far. Spending less can help offset higher prices.

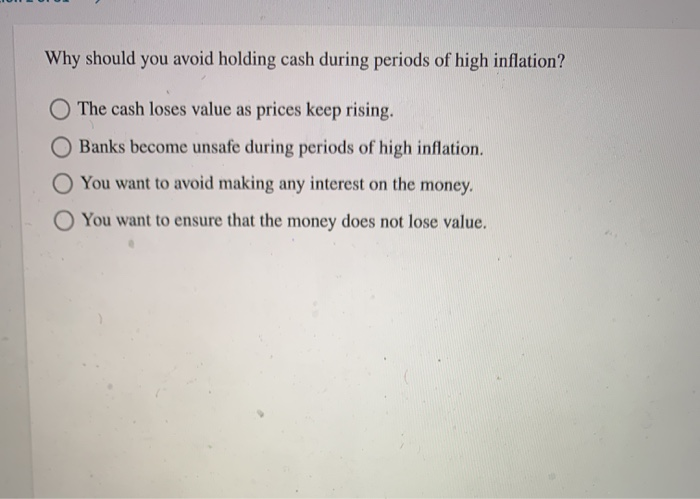

Why is holding cash bad in inflation

Missing out on opportunities. If you just hold onto cash during periods of high inflation, then it's actually losing value more rapidly. Various assets, such as stocks, commodities, and equities can match or outperform the inflation rate.

What is the best way to protect cash from inflation

5 Ways to Hedge Against InflationMove Your Money into a High-Yield Savings Account. If you have your money stashed in a checking or basic savings account—or worse, at home—inflation erodes the value over time.Buy Treasury Bonds.Invest in the Stock Market.Diversify Your Portfolio.Explore Alternative Investments.

What is the best currency to hold during inflation

The Japanese Yen has often been regarded as a safe haven for US dollar holders in times of economic uncertainty. Japan's historically steady economic growth and inflation rate have resulted in tame exchange rate fluctuations, providing a hedge against the inflation-induced devaluation of the US dollar.

What are the worst investments during inflation

Holding long-term fixed-rate investments, such as long-term bonds, fixed annuities, and some types of life insurance policies, during inflation can be bad because their returns may not keep up with inflation.

What investments should be avoided during inflation

4. Avoid Long-Term Fixed-Income Investments. The worst investment to put money into, during periods of inflation, are long-term, fixed-rate interest-bearing investments. These can include any interest-bearing debt securities that pay fixed rates, but especially those with maturities of 10 years or longer.

How much is too much cash in savings

How much is too much The general rule is to have three to six months' worth of living expenses (rent, utilities, food, car payments, etc.) saved up for emergencies, such as unexpected medical bills or immediate home or car repairs. The guidelines fluctuate depending on each individual's circumstance.

How does Warren Buffett hold his cash

The bulk of Berkshire's cash—more than $100 billion—sits in Treasury bills. Unlike banks, Buffett was willing to sit in T-bills when they yielded next to nothing in 2020 and 2021 and now is benefiting as T-bill rates are at 5%. Buffett likes the security of T-bills versus other short-term investments.

What not to buy during inflation

Not only are gas prices high, but the price of airline tickets was up 34% year over year in June. The cost of hotels, too, is 10% higher, according to consumer price index data. Do not buy items on credit cards. Some cards charge over 20% interest rates.

Can you stop inflation by destroying money

Money burning is thus equivalent to gifting the money back to the central bank (or other money issuing authority). If the economy is at full employment equilibrium, shrinking the money supply causes deflation (or decreases the rate of inflation), increasing the real value of the money left in circulation.

Does a strong dollar help or hurt inflation

The strong dollar feeds into inflation pressures abroad.

When a country's currency weakens against the dollar, the price of imports from the United States rises, putting pressure on prices.

What is the safest asset during inflation

Savings Bonds

These are typically considered safe investments because the value can't decline, which makes them a stabilizing investment during inflation or other periods of uncertainty.

What should I invest in to beat inflation

How to Beat Inflation. Investing in assets with returns that outpace the rate of inflation is one of the best ways consumers can beat inflation.Beat Inflation by Investing in Gold.Invest in Stocks to Beat Inflation.Beat Inflation with Real Estate.TIPS Are Designed to Beat Inflation.Beat Inflation with I Bonds.

What are the three investments one can make to beat inflation

5 ways investors can stay protected against inflationTIPS. TIPS, or Treasury inflation-protected securities, are a useful way to protect your investment in government bonds if you expect inflation to stay high or speed up.Floating-rate bonds.A house.Stocks.Gold.Long-dated bonds.Long-dated fixed-rate CDs.

Should I withdraw my money from the bank 2023

Do no withdraw cash. Despite the recent uncertainty, experts don't recommend withdrawing cash from your account. Keeping your money in financial institutions rather than in your home is safer, especially when the amount is insured. "It's not a time to pull your money out of the bank," Silver said.

Is 100k too much in savings

But some people may be taking the idea of an emergency fund to an extreme. In fact, a good 51% of Americans say $100,000 is the savings amount needed to be financially healthy, according to the 2022 Personal Capital Wealth and Wellness Index. But that's a lot of money to keep locked away in savings.

What bank does Warren Buffett keep his money at

OMAHA, Neb. (AP) — Investor Warren Buffett recommitted to his favorite bank stock, Bank of America, during the first quarter while dumping two other banks as part of a number of moves in Berkshire Hathaway's stock portfolio.

Is Berkshire Hathaway holding cash

The company grew its cash stockpile to $130.6 billion, the largest it's been since 2021.

What items are hit hardest by inflation

Top 10 inflation categories for December 2022

| Food at elementary + secondary schools | 305.2% |

|---|---|

| Eggs | 59.9% |

| Margarine | 43.8% |

| Fuel oil | 41.5% |

| Motor fuelsExcluding gasoline | 32.3% |

What happens if cash is destroyed

If money is destroyed (taken out of circulation) and not put back in by the Central Bank, then the overall money supply in the economy will fall. There will be less money circulating. Prices will tend to fall, and the value of the remaining money increase.

Does inflation help or hurt the rich

The result is the wealth continues to concentrate in the hands of fewer and fewer people. This happens because inflation hurts the lower incomes but actually enriches the higher incomes.

Is money worth more when inflation is high

The impact inflation has on the time value of money is that it decreases the value of a dollar over time.

Is USD getting stronger 2023

The 2023 Outlook for Major Currency Pairs

EUR/USD is predicted to reach 1.10 in March 2023, before declining to 1.08 September 2023 and holding at 1.08 in December 2023. USD/JPY is expected to hit 135 in March 2023, before trading at 133 in June 2023, 130 in September 2023 and 128 in December 2023.

Is it better to have cash or assets during inflation

Because there is no chance of a decline in value, “cash is the best option, even if inflation is a risk factor,” she says.

Who benefits from high inflation

Here are the seven winners who can actually benefit from inflation.Collectors.Borrowers With Existing Fixed-Rate Loans.The Energy Sector.The Food and Agriculture Industry.Commodities Investors.Banks and Mortgage Lenders.Landowners and Real Estate Investors.