What happens to people who retire with no money?

How do I survive retirement with no savings

How To Retire With No SavingsMake Every Dollar Count — and Count Every Dollar.Downsize Your House — and Your Life.Pick Your Next Location With Savings in Mind.Or, Stay Where You Are and Trade Your Equity for Income.Get the Most Out of Healthcare Savings Programs.Delay Retirement — and Social Security.

Cached

How many people retire with no money

About 27% of people who are 59 or older have no retirement savings, according to a new survey from financial services firm Credit Karma.

How to retire in 5 years with no savings

How You Can Retire in 5 Years Even Without SavingsMake a Plan. First, you'll need to do some in-depth analysis of your spending, future costs and the steps you'll need to take in the next five years.Cut Costs.Pay Off or Refinance Debt.Save and Invest.Enlist an Expert.Bottom Line.Retirement Planning Tips.

What happens to senior citizens when they run out of money

Aging adults without money to support them through the rest of their lives can stay in a nursing home for up to 100 days—and Medicaid will cover the cost for this brief period. Seniors who reside in an assisted living facility and run out of funds will be evicted.

How to retire in 10 years with no savings

How to Retire In 10 Years with No SavingsMake the Commitment. The first step in preparing to retire in 10 years is simply deciding that you want to do it.Cut Your Costs.Save 75% of Your Income.Invest Your Savings Wisely.Invest for Income.

Can you retire if you never worked

The only way to receive Social Security benefits if you have not worked is if you are the dependent or spouse of a deceased worker. Each month, millions of workers pay a portion of their income to the Social Security Administration, and later will be allowed to rely on a modest income in retirement.

How much money does the average person retire with

The national average for retirement savings varies depending on age, but according to the Economic Policy Institute, the median retirement savings for all working age households in the US is around $95,776. This figure includes both employer-sponsored retirement accounts and individual retirement accounts (IRAs).

How long will $300 000 last in retirement

approximately 25 years

This is also not accounting for rising costs due to inflation, large, unexpected costs and taxes. On the other hand, if they're able to continue to live this affordably, they can estimate their $300,000 in savings will last approximately 25 years.

Can I retire at 62 with 300k

The short answer to this question is, “Yes, provided you are prepared to accept a modest standard of living.” To get an an idea of what a 60-year-old individual with a $300,000 nest egg faces, our list of factors to check includes estimates of their income, before and after starting to receive Social Security, as well …

What happens to old people with no money and no family

If you have no family, no money, you become a ward of the state or county. The state assigns a guardian to you, and that person makes the decisions about your living situation, your health care, your finances.

What to do if you are retired and broke

7 Must-Do's if You're Retired and BrokeTip #1: Create a budget for your monthly expenses and stick to it.Tip #2: Clear out any outstanding debt.Tip #3: Learn how to invest.Tip #4: Start your own business as a retiree entrepreneur.Tip #5: Set money aside for an emergency fund.Tip #6: Cut down on housing costs.

How can I retire at 65 with no savings

How to Bounce Back at Age 65 With No Retirement SavingsWork Longer.Maximize Government Benefits.Contribute to Retirement Accounts.Trim Your Lifestyle.Build an Emergency Fund.

What to do if you haven t saved for retirement by age 50

If you didn't make saving for retirement a priority early in life, it's not too late to catch up. At age 50, you can start making extra contributions to your tax-sheltered retirement accounts (called catch-up contributions). Younger workers can only contribute $22,500 to their 401(k)s and $6,500 to their IRAs in 2023.

What is the lowest amount of Social Security

The Social Security special minimum benefit provides a primary insurance amount (PIA) to low-earning workers. The lowest minimum PIA in 2023, with at least 11 years of work, is $49.40 per month. The full minimum PIA, which requires at least 30 years of work, is $1,033.50 per month.

What happens if you don t have enough credits for Social Security

You can still earn credits and become fully insured if you work. We cannot pay you benefits if you don't have enough credits. This fact sheet will tell you more about earning credits to qualify for benefits and how both the number of years you work and how much you earn affect your benefit amount.

How much does the average retired person live on per month

People ages 65 and older had an average income of $55,335 in 2021. Average annual expenses for people ages 65 and older totaled $52,141 in 2021. 48% of retirees surveyed reported spending less than $2,000 a month in 2022. 1 in 3 retirees reported spending between $2,000 and $3,999 per month.

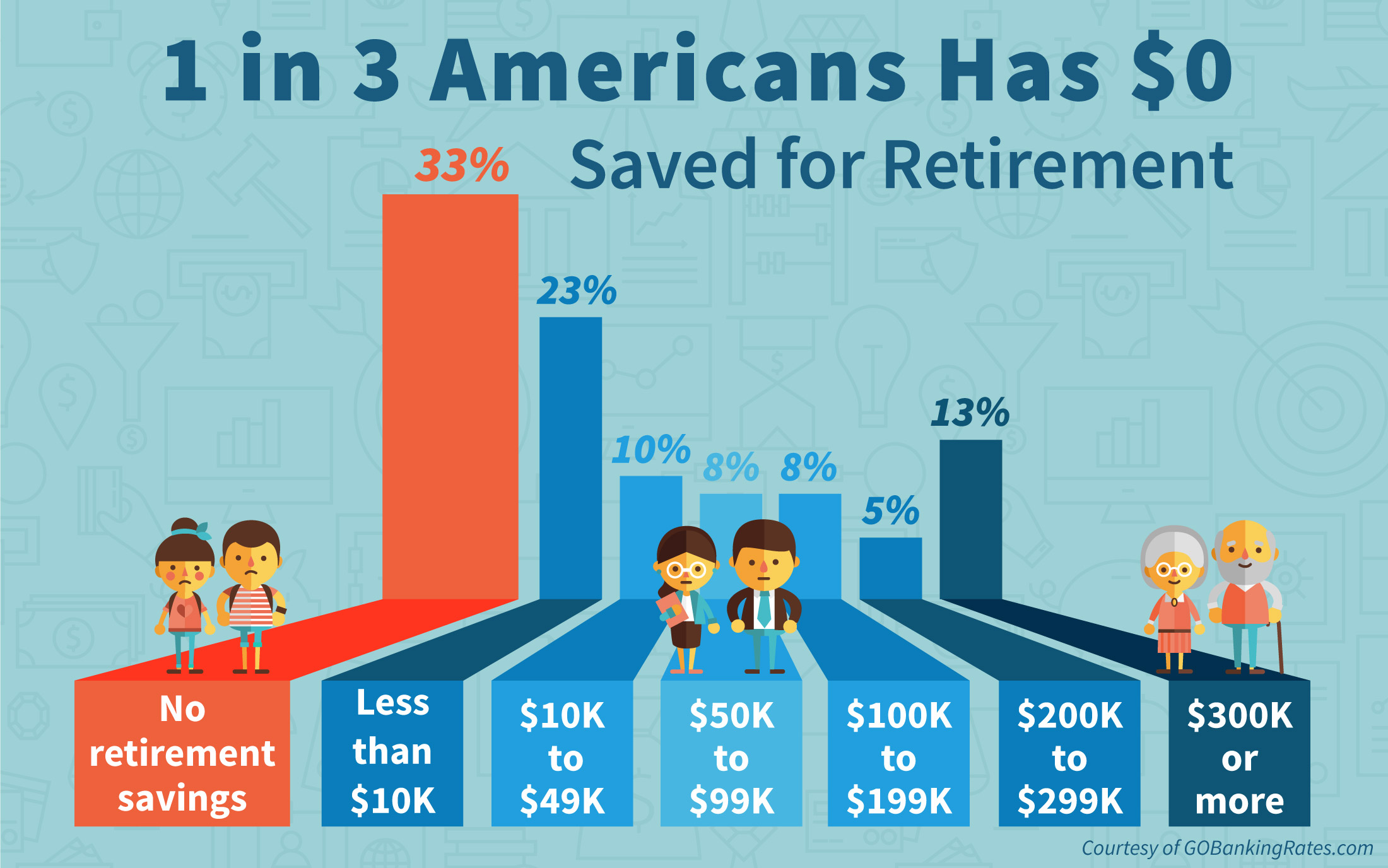

How many Americans have no savings

53% of Americans say they don't have any emergency savings—3 tips to get started.

How many Americans have $300,000 in savings

16 percent

– Nearly 10 percent have $200,000 to $299,999. – About 16 percent have $300,000 or more in retirement savings.

What is the average 401k balance for a 65 year old

Average and median 401(k) balance by age

| Age | Average Account Balance | Median Account Balance |

|---|---|---|

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

| 55-64 | $256,244 | $89,716 |

| 65+ | $279,997 | $87,725 |

How to retire at 60 with no money

How to Retire With No Money: A Guide to a Frugal RetirementAssess Your Financial Situation.Embrace Frugality.Maximize Your Income Sources.Part-time Job or Side Hustle.Rent Out a Spare Room on Airbnb.Sell Items You No Longer Need.Apply for Government Benefits.Invest in Dividend-Paying Stocks or Rental Properties.

How much Social Security will I get if I make $35000 a year

Simply put it's your monthly pay for the last 35 years there's still some math to get through your benefits are determined by been points in an equation. Almost like a tax bracket.

What do seniors do when they run out of money

Aging adults without money to support them through the rest of their lives can stay in a nursing home for up to 100 days—and Medicaid will cover the cost for this brief period. Seniors who reside in an assisted living facility and run out of funds will be evicted.

What happens if you are old and alone

Research has linked social isolation and loneliness to higher risks for a variety of physical and mental conditions: high blood pressure, heart disease, obesity, a weakened immune system, anxiety, depression, cognitive decline, Alzheimer's disease, and even death.

How do retired people get money

Guaranteed Income (i.e. Social Security, Annuities) Pension plans (i.e., defined benefit plans) IRAs. Qualified employer sponsored retirement plans (QRP) such as, including 401(k), 403(b), and governmental 457(b)

Is it possible to run out of money during retirement

The first thing to understand is that running out of retirement money is possible. This typically happens when people don't plan carefully for their retirement income and essential expenses. As a result, they may spend more than expected or not have enough income to cover their costs.