How much cash should I have at 65?

How much cash should a 65 year old have

Despite the ability to access retirement accounts, many experts recommend that retirees keep enough cash on hand to cover between six and twelve months of daily living expenses. Some even suggest keeping up to three years' worth of living expenses in cash. Your emergency fund must be easy for you to access at any time.

Cached

How much savings do most 65 year olds have

How Much Does the Average 70-Year-Old Have in Savings According to data from the Federal Reserve's most recent Survey of Consumer Finances, the average 65 to 74-year-old has a little over $426,000 saved.

How much should you have in the bank to retire at 65

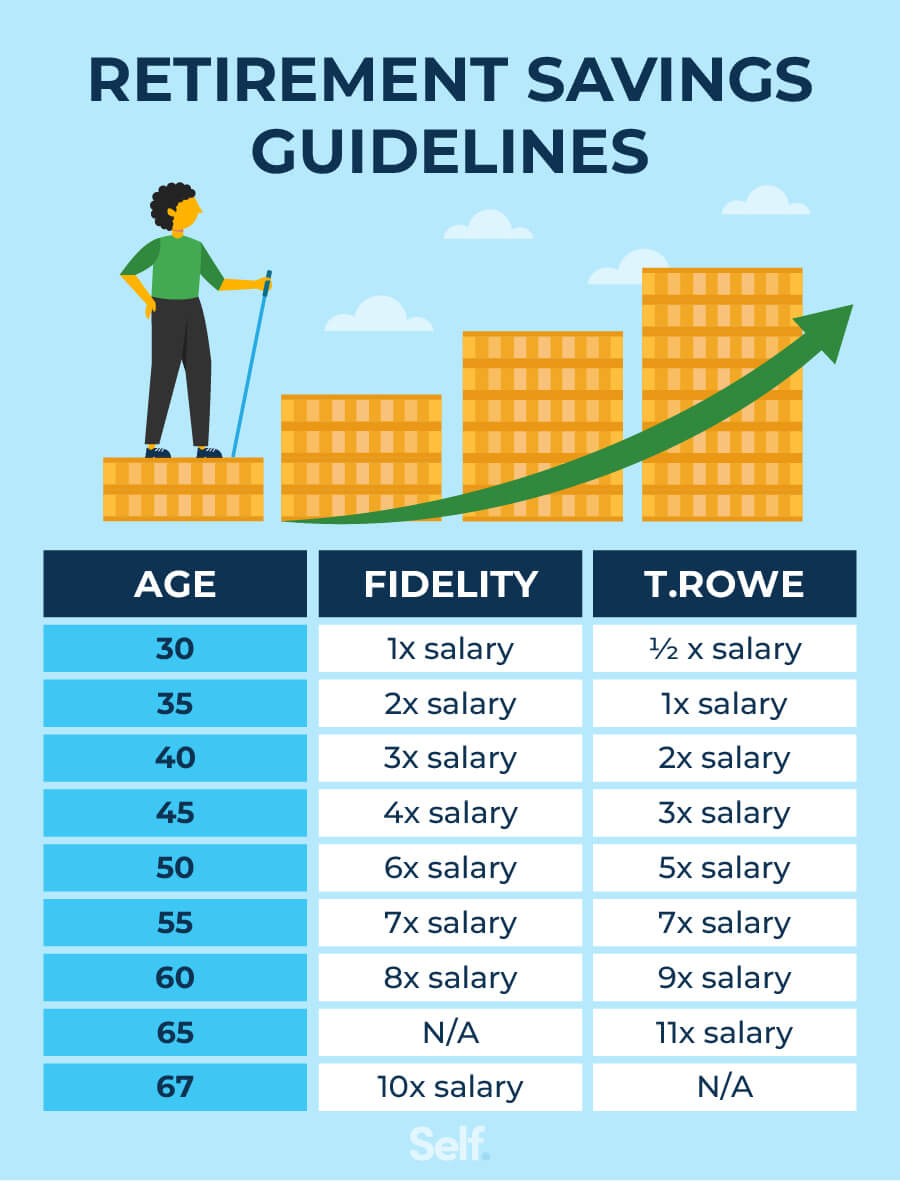

Use these insights to help determine whether your retirement plan is on the right track. Retirement experts have offered various rules of thumb about how much you need to save: somewhere near $1 million, 80% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary.

CachedSimilar

Is $1,000,000 enough to retire at 65

Yes, it is possible to retire with $1 million at the age of 65. But whether that amount is enough for your own retirement will depend on factors that include your Social Security benefits, your investment strategy and your personal expenses.

Is $300,000 enough to retire at 65

In most cases, you will have to wait until age 66 and four months to collect enough Social Security for a stable retirement. If you want to retire early, you will have to find a way to replace your income during that six-year period. In most cases $300,000 is simply not enough money on which to retire early.

What is the average 401k balance at age 65

Average and median 401(k) balance by age

| Age | Average Account Balance | Median Account Balance |

|---|---|---|

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

| 55-64 | $256,244 | $89,716 |

| 65+ | $279,997 | $87,725 |

How many people have $1000000 in retirement savings

In fact, statistically, around 10% of retirees have $1 million or more in savings.

What is the average 401k balance for a 65 year old

Average and median 401(k) balance by age

| Age | Average Account Balance | Median Account Balance |

|---|---|---|

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

| 55-64 | $256,244 | $89,716 |

| 65+ | $279,997 | $87,725 |

Can I retire at 65 with 500k

The quick answer is “yes”! With some planning, you can retire comfortably with $500k. Remember, however, that your lifestyle will significantly affect how long your savings will last.

How much money does the average American retire with

The national average for retirement savings varies depending on age, but according to the Economic Policy Institute, the median retirement savings for all working age households in the US is around $95,776.

What percentage of US population has $2 million dollars

Additionally, statistics show that the top 2% of the United States population has a net worth of about $2.4 million. On the other hand, the top 5% wealthiest Americans have a net worth of just over $1 million. Therefore, about 2% of the population possesses enough wealth to meet the current definition of being rich.

Do most retirees have a million dollars

In fact, statistically, around 10% of retirees have $1 million or more in savings. The majority of retirees, however, have far less saved. If you're looking to be in the minority but aren't sure how to get started on that savings goal, consider working with a financial advisor. What Does the Average Retiree Have Saved

Is $2 million enough to retire at 65

Although 65 is a conventional retirement age, reaching this point with $2 million is quite a feat. This sum can generate investment and interest income to support you well in the decades to come. However, saving this amount takes effort.

Can I retire on $2 million at 65

Yes, for some people, $2 million should be more than enough to retire. For others, $2 million may not even scratch the surface. The answer depends on your personal situation and there are lot of challenges you'll face. As of 2023, it seems the number of obstacles to a successful retirement continues to grow.

What net worth is considered wealthy

Americans say it takes $2.2 million to qualify as wealthy these days, according to Charles Schwab's (SCHW) 2023 Modern Wealth survey. When Schwab started doing the survey in 2017, respondents said it took $2.4 million to be considered wealthy.

What percentage of Americans have $100000 for retirement

14%

14% of Americans Have $100,000 Saved for Retirement

Most Americans are not saving enough for retirement. According to the survey, only 14% of Americans have $100,000 or more saved in their retirement accounts. In fact, about 78% of Americans have $50,000 or less saved for retirement.

Can I live off the interest of 2 million dollars

Can you live off of $2 million in assets The answer is yes, if you manage your investment portfolio smartly. One common option is to invest $2 million in an index fund. But you will still need to make absolutely sure that you have a rainy day fund since the market can be reliable over decades but fickle over years.

What age can you retire with $3 million

You can probably retire in financial comfort at age 45 if you have $3 million in savings. Although it's much younger than most people retire, that much money can likely generate adequate income for as long as you live.

Does net worth determine if you are a millionaire

Someone is considered a millionaire when their net worth, or their assets minus their liabilities, totals $1 million or more.

What net worth by age is rich

Between 35 to 44, the average net worth is $436,200, while between 45 to 54 that number increases to $833,200. Average net worth cracks the $1 million mark between 55 to 64, reaching $1,175,900. Average net worth again rises for those ages 65 to 74, to $1,217,700, before falling to $977,600 for someone over age 75.

How many Americans have $2 million in savings

We estimate there are 8,046,080 US households with $2 million or more in net worth. That is roughly 6.25% of all US Households.

How much cash does the average American retire with

The national average for retirement savings varies depending on age, but according to the Economic Policy Institute, the median retirement savings for all working age households in the US is around $95,776. This figure includes both employer-sponsored retirement accounts and individual retirement accounts (IRAs).

What percent of retirees have a million dollars

In fact, statistically, around 10% of retirees have $1 million or more in savings. The majority of retirees, however, have far less saved. If you're looking to be in the minority but aren't sure how to get started on that savings goal, consider working with a financial advisor.

Can I live off interest on 3 million dollars

If you have $3 million to invest, you can safely and reliably earn anywhere from $3,000 to much as $82,500 a year in interest. If you are ready take more risk, you may earn more. But risk also means the possibility of lower returns or even losses.

What percentage of Americans have a net worth of over $1000000

There are 5.3 million millionaires and 770 billionaires living in the United States. Millionaires make up about 2% of the U.S. adult population. While an ultra-high net worth will be out of reach for most, you can amass $1 million by managing money well and investing regularly.