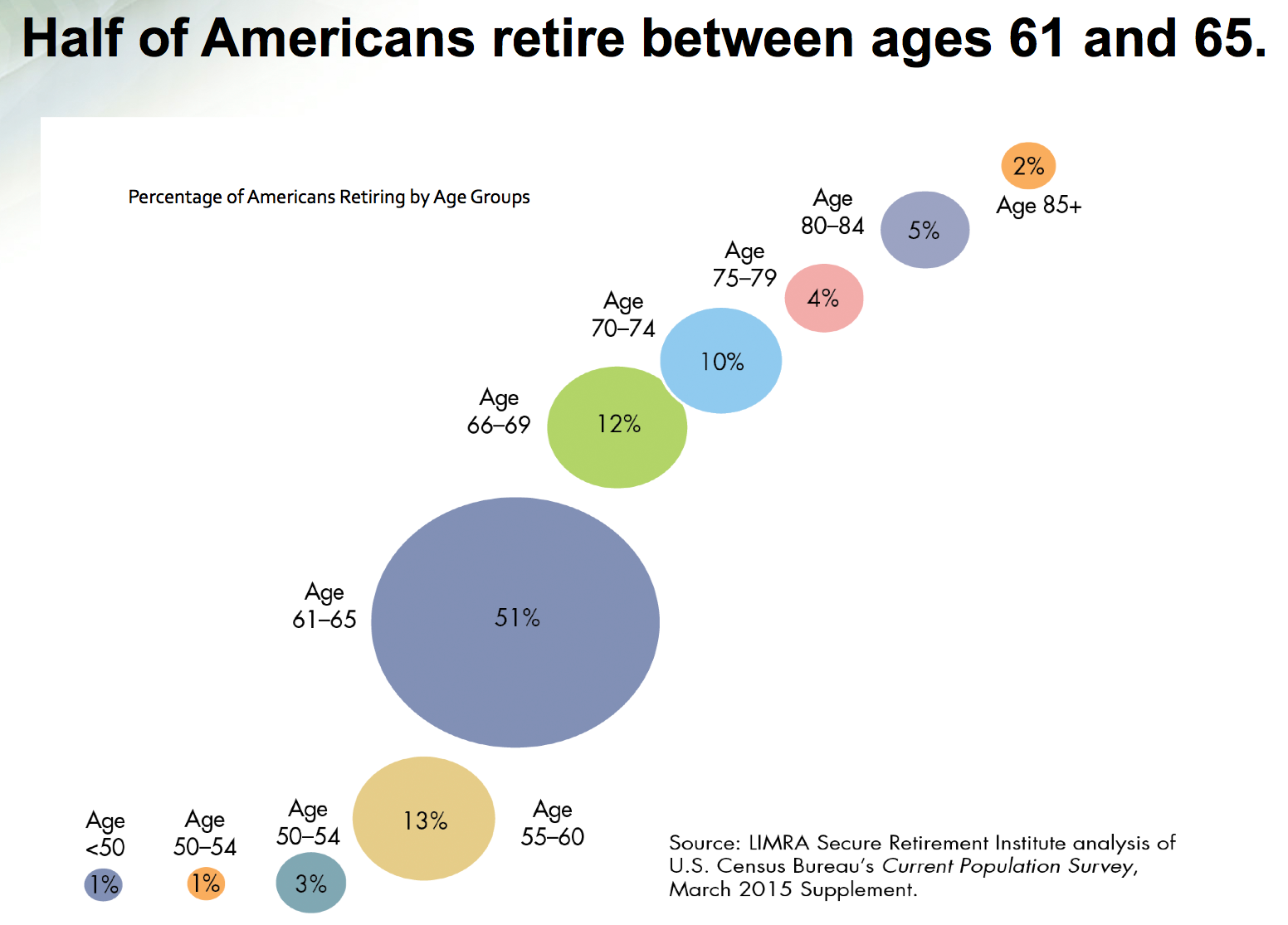

At what age do most people retire?

Do most people retire at 55

But it's important to keep in mind that retiring at 55 isn't the norm for most people. If you're going by the normal retirement age prescribed by Social Security, for example, that usually means waiting until you're 66 or 67.

Is $3 million enough to retire at 55

If you're retiring at 55 instead of 66, you have 11 extra years of expenses and 11 fewer years of income that your savings will need to cover. The good news: As long as you plan carefully, $3 million should be a comfortable amount to retire on at 55.

Can I retire at 55 with $2 million

If you have multiple income streams, a detailed spending plan and keep extra expenses to a minimum, you can retire at 55 on $2 million. However, because each retiree's circumstances are unique, it's essential to define your income and expenses, then run the numbers to ensure retiring at 55 is realistic.

Do you live longer if you retire early

Men responding to the early retirement offer were 2.6 percentage points less likely to die over the next five years than those who did not retire early. (Too few women met the early retirement eligibility criteria to be included in the study.)

Can I retire at 42 with $5 million dollars

Retiring at age 40 is entirely feasible if you have accumulated $5 million by that age. If the long-term future is much like the long-term past, you will be able to withdraw $200,000 the first year for living expenses and adjust that number up for inflation every year more or less forever without running out of money.

Can I retire at 65 with $5 million dollars

The answer to this question is a resounding yes! You can retire on five million dollars. You could retire quite comfortably on that amount of money.

Can I retire at 56 with 4 million dollars

The average age at which most people retire is 62, according to a 2021 Gallup Poll. But if you have $4 million in savings, it's entirely possible to retire by age 55. Retiring early offers a lot of advantages.

How long does the average retiree live

A 65-year-old can expect to live another 19 to 21.5 years, on average, according to the Social Security Administration. What's more, the government agency says a third of 65-year-olds will hit age 90, and 1 in 7 will live beyond age 95.

How many years does the average person work before retiring

The average age of retirement, however, is about 64. This suggests a working career of 46 years is someone who starts at 18, and 42 years for a college graduate. And some people wait until between the ages of 65 to 67 to receive full Social Security benefits.

What percentage of people retire with $1000000

According to the Schroders 2023 U.S. Retirement Survey, working Americans age 45 and older expect they will need about $1.1 million in savings in order to retire, but only 21% of people in that age group expect to have even $1 million. That's down slightly from the 24% in 2022 who said they expected to save that much.

Can you retire $1.5 million comfortably

The 4% rule suggests that a $1.5 million portfolio will provide for at least 30 years approximately $60,000 a year before taxes for you to live on in retirement. If you take more than this from your nest egg, it may run short; if you take less or your investments earn more, it may provide somewhat more income.

Is $2 million enough for a couple to retire at 65

Following the 4 percent rule for retirement spending, $2 million could provide about $80,000 per year. That's more than average. The Bureau of Labor Statistics reports that the average 65-year-old spends roughly $4,345 per month in retirement — or $52,141 per year.

Is $10 million enough to retire at 50

While $10 million is a lot of money, retiring at 50 means you can plan on approximately 40 years of retirement if you expect to live to around the average age. Even if nothing catastrophic happens to you or the economy in the meantime, inflation alone can make a dent in what you can expect from your savings.

Does retiring early make you live longer

Men responding to the early retirement offer were 2.6 percentage points less likely to die over the next five years than those who did not retire early. (Too few women met the early retirement eligibility criteria to be included in the study.) The Dutch study echoes those from other countries.

How much money does the average person retire with

The national average for retirement savings varies depending on age, but according to the Economic Policy Institute, the median retirement savings for all working age households in the US is around $95,776. This figure includes both employer-sponsored retirement accounts and individual retirement accounts (IRAs).

What is an ideal retirement

So to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target. By age 50, you would be considered on track if you have three to six times your preretirement gross income saved.

How much Social Security will I get if I make $60000 a year

And older receive Social Security benefits. Making it an essential part of retiring in the u.s.. Benefits are based on your income.

Can I retire at 56 with $3 million dollars

Yes, you can retire at 55 with three million dollars. At age 55, an annuity will provide a guaranteed income of $168,750 annually, starting immediately for the rest of the insured's lifetime. The income will stay the same and never decrease.

Can you retire at 65 with $3 million

To some people, $3 million will sound like a lot. You probably think $3 million is enough to retire if you're among that crowd. But retiring with $3 million at 65 can last depending on your longevity, lifestyle and other factors.

Can I retire at 60 with 500k

The quick answer is “yes”! With some planning, you can retire at 60 with $500k. Remember, however, that your lifestyle will significantly affect how long your savings will last.

Can I retire at 60 with $2 million dollars

Yes, for some people, $2 million should be more than enough to retire. For others, $2 million may not even scratch the surface. The answer depends on your personal situation and there are lot of challenges you'll face. As of 2023, it seems the number of obstacles to a successful retirement continues to grow.

Is $2 million enough to retire for a couple

A $2 million retirement account invested entirely in an S&P 500 index fund would return an average of $200,000 per year. That's enough for most households to live on without even dipping into the principal, but in some years that account would take significant losses.

Can I retire with $2 million dollars at age 55

Is $2 Million Enough to Retire at 55 A $2 million nest egg can provide $80,000 of annual income when the principal gives a return of 4%. This estimate is on the conservative side, making $80,000 a solid benchmark for retirement income with this sum of money.

Are people happier if they retire early

Generally, people who have retired early said they were happier, had better relationships with family and friends, and had improved mental and physical wellbeing.

What is the average 401k balance for a 65 year old

Average and median 401(k) balance by age

| Age | Average Account Balance | Median Account Balance |

|---|---|---|

| 35-44 | $97,020 | $36,117 |

| 45-54 | $179,200 | $61,530 |

| 55-64 | $256,244 | $89,716 |

| 65+ | $279,997 | $87,725 |