How many retirees have no savings?

How many retired people have no savings

About 27% of people who are 59 or older have no retirement savings, according to a new survey from financial services firm Credit Karma.

Cached

What percent of Americans don t have the savings to retire

A new survey finds 27% of people aged 59 and older have no money set aside for their later years.

Cached

What percentage of retirees have no mortgage

Nearly Three-Quarters of Retired Americans Have Non-Mortgage Debt. Because so many retirees have little to no savings, it's not too surprising that the majority are carrying debt. The most common types of debt held by retirees are credit card debt (49%), mortgages (24%), car payments (20%) and medical bills (18%).

Cached

How much does the average 65 year old retiree have in savings

According to data from the Federal Reserve's most recent Survey of Consumer Finances, the average 65 to 74-year-old has a little over $426,000 saved.

Can you retire with no savings

Yes, it is possible to retire with no money. While it may be challenging, it is achievable by adopting a frugal lifestyle and maximizing your income sources.

How much money does the average retiree have saved

The national average for retirement savings varies depending on age, but according to the Economic Policy Institute, the median retirement savings for all working age households in the US is around $95,776. This figure includes both employer-sponsored retirement accounts and individual retirement accounts (IRAs).

How much does the average 70 year old have in savings

Federal Reserve SCF Data

| Age range | Median Retirement Savings |

|---|---|

| Americans aged 45-54 | $100,000 |

| Americans aged 55-64 | $134,000 |

| Americans aged 65-74 | $164,000 |

| Americans aged 75+ | $83,000 |

What does the average person retire with

The national average for retirement savings varies depending on age, but according to the Economic Policy Institute, the median retirement savings for all working age households in the US is around $95,776. This figure includes both employer-sponsored retirement accounts and individual retirement accounts (IRAs).

Do most retirees have their homes paid off

Many Retired People Don't Expect to Pay Off Mortgages

Traditionally, homeowners looked forward to paying off their mortgage before retirement and living out their golden years without the heavy burden of a monthly house payment. But that scenario is becoming less common, according to a recent survey.

How much debt does the average retiree have

Seniors age 75 and older have by far the lowest average debt. Among those who carry debt, the average debt level is just $87,300. Seniors in this age group had some advantages over other age groups. Of course, they've had more years to earn money and pay down their mortgages.

How much money do most people retire with

Federal Reserve SCF Data

| Age range | Median Retirement Savings |

|---|---|

| Americans aged 45-54 | $100,000 |

| Americans aged 55-64 | $134,000 |

| Americans aged 65-74 | $164,000 |

| Americans aged 75+ | $83,000 |

What percentage of people have no savings

Half of Americans are struggling to save, despite the strong job market. Forty-nine percent of Americans have less or no savings than a year ago. And only 43 percent said they could cover an emergency of $1,000 or more using funds from their savings account.

How many older Americans haven’t saved anything for retirement

A new survey finds 27% of people aged 59 and older have no money set aside for their later years. (Bloomberg) — More than a quarter of Americans have no money saved for retirement.

What percentage of retirees have $500,000 in savings

In 2019, about 50% of households reported any savings in retirement accounts. Twenty-one percent had saved more than $100,000, and 7% had more than $500,000. These percentages were only somewhat higher for older people. Those ages 51 to 55 were the most likely to have a retirement account.

How much money does the average person retire with

The national average for retirement savings varies depending on age, but according to the Economic Policy Institute, the median retirement savings for all working age households in the US is around $95,776. This figure includes both employer-sponsored retirement accounts and individual retirement accounts (IRAs).

How to retire at 65 with no savings

How To Retire With No SavingsMake Every Dollar Count — and Count Every Dollar.Downsize Your House — and Your Life.Pick Your Next Location With Savings in Mind.Or, Stay Where You Are and Trade Your Equity for Income.Get the Most Out of Healthcare Savings Programs.Delay Retirement — and Social Security.

What percentage of retirees have their homes paid off

21%! While most Americans expect to have their mortgage paid off by retirement, more than one in five of those individuals are still paying off their homes at age 75.

What is the average debt for a 70 year old

The Average Debt for Those 65-74

In a perfect world, you would be debt-free by the time you retire. That scenario is not realistic for many Americans, however. Householders in this age group who have debt carry an average debt of $105,250.

How much does the average person have in their bank account when they retire

The Federal Reserve's most recent data reveals that the average American has $65,000 in retirement savings. By their retirement age, the average is estimated to be $255,200.

What happens if you have no retirement savings

Without savings, it will be difficult to maintain in retirement the same lifestyle that you had in your working years. You may need to make adjustments such as moving into a smaller home or apartment; forgoing extras such as cable television, an iPhone, or a gym membership; or driving a less expensive car.

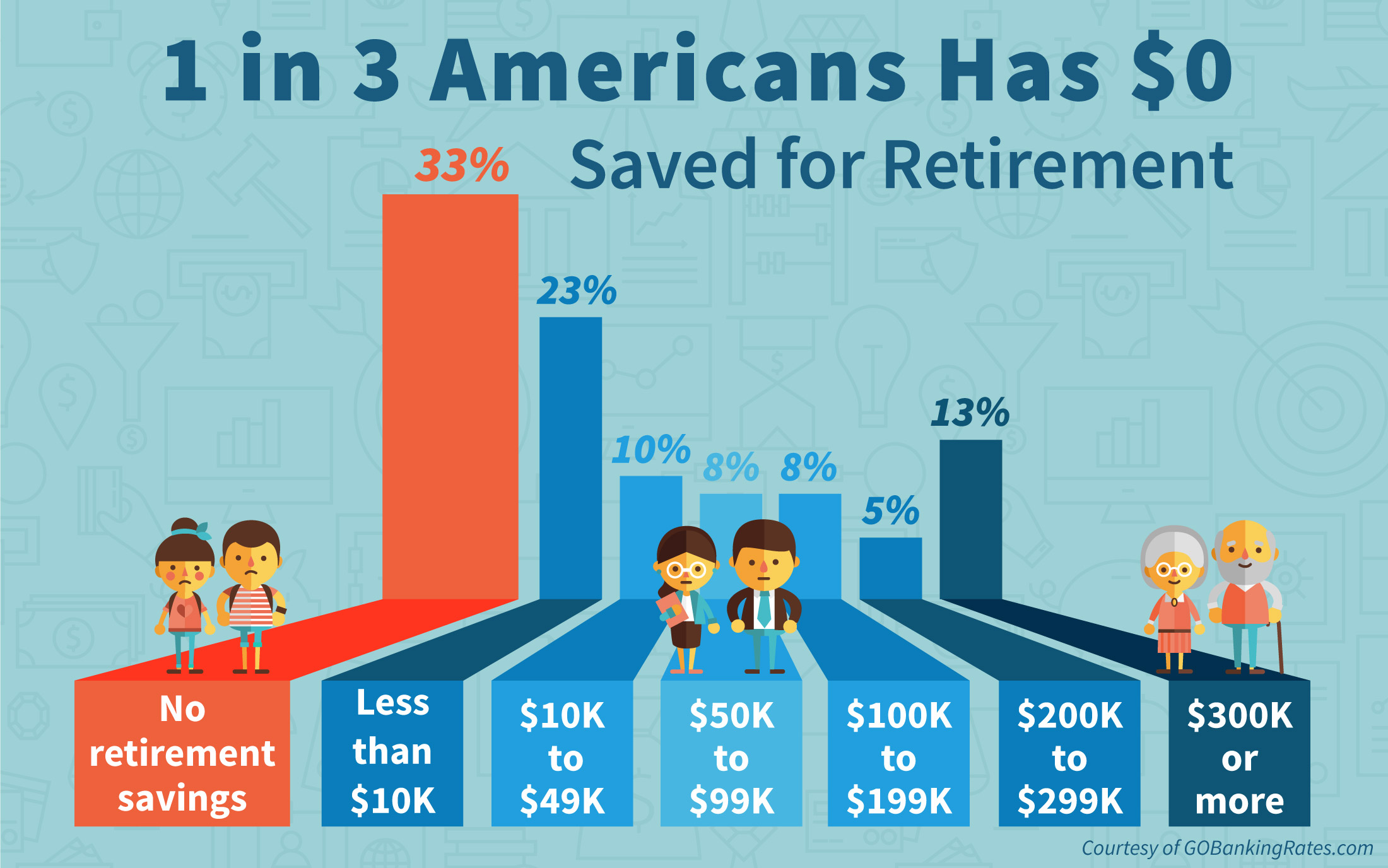

How many Americans have $0 in savings

Nearly half (49 percent) of U.S. adults have less savings (39 percent) or no savings (10 percent) compared to a year ago, according to a new Bankrate survey. This data comes from Bankrate's yearly emergency savings report, an exclusive survey done by Bankrate and polling partner SSRS.

Do most Americans not have any savings

At least 53% of Americans admit they don't have an emergency fund, according to a recent poll conducted by CNBC and Momentive. That figure skyrockets to at least 74% for those with a household income below $50,000 per year.

How many retirees are poor

In total, almost 6 million older adults live below the poverty level.

What does the average American have when they retire

However, according to the Federal Reserve's “Report on the Economic Well-Being of U.S. Households in 2019,” 60% of Americans either do not realize if they're on track or are unsure if they're on track. The Federal Reserve's most recent data reveals that the average American has $65,000 in retirement savings.

What percentage of Americans have $100000 for retirement

14%

14% of Americans Have $100,000 Saved for Retirement

Most Americans are not saving enough for retirement. According to the survey, only 14% of Americans have $100,000 or more saved in their retirement accounts. In fact, about 78% of Americans have $50,000 or less saved for retirement.