What happens if you have more than 250 000 in bank?

What to do if you have over $250 000 in the bank

Open an account at a different bank.Add a joint owner.Get an account that's in a different ownership category.Join a credit union.Use IntraFi Network Deposits.Open a cash management account.Put your money in a MaxSafe account.Opt for an account with both FDIC and DIF insurance.

Cached

Does the FDIC insure $250000 in multiple accounts

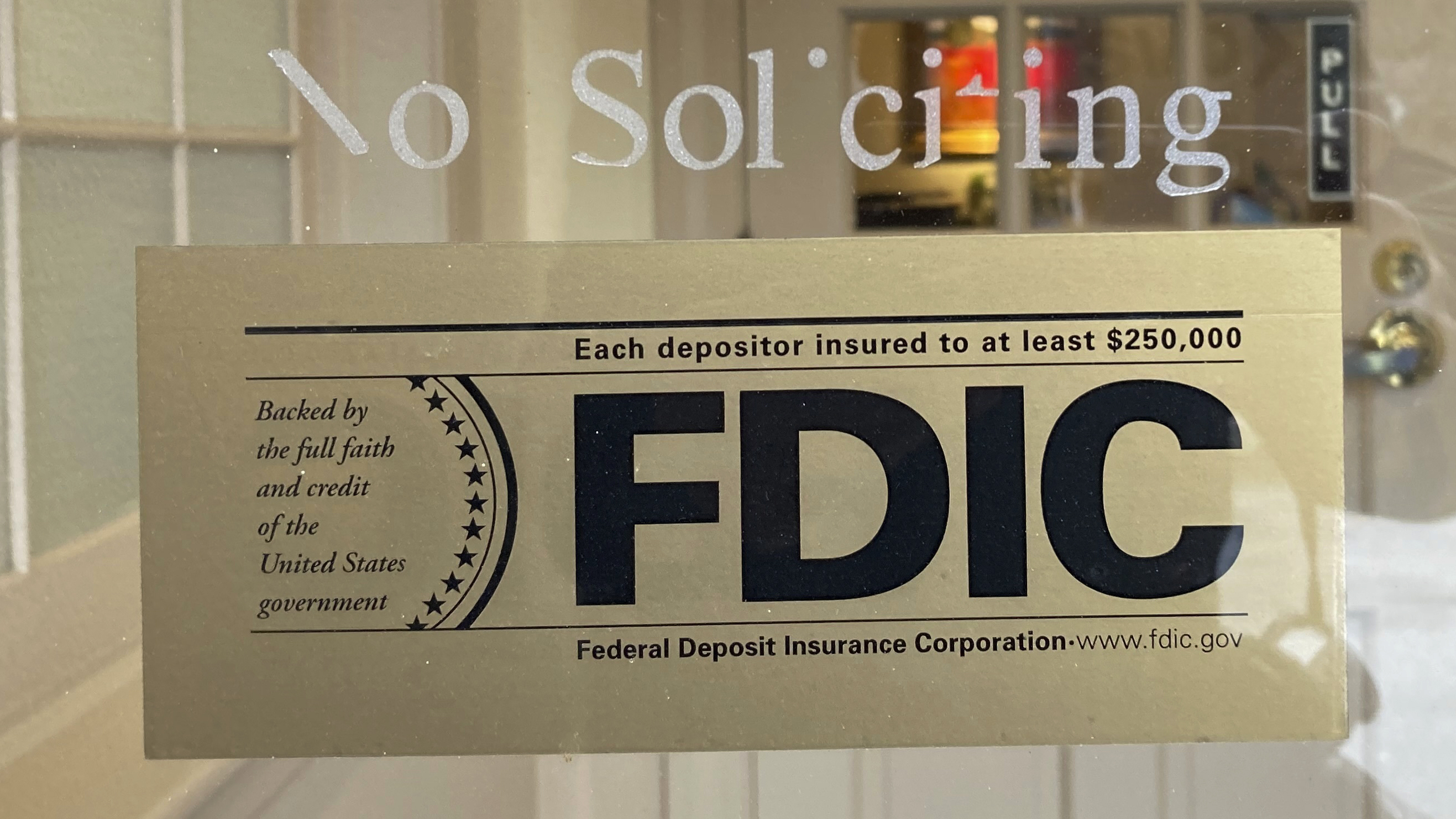

The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank.

Cached

What is the maximum amount of money I can have in my bank account

Minimum balances aside, how much money can you have in a checking account There is no maximum limit, but your checking account balance is only FDIC insured up to $250,000. However, as we'll cover shortly, it makes sense to put extra cash somewhere it will earn interest.

What happens if you have too much money in your bank account

Most savings accounts will insure your money up to $250,000 per an account holder for every account, but anything beyond that amount is not guaranteed to be reimbursed in the event something happened, like the bank collapsed.

How can I protect more than 250k in bank

Here are seven of the best ways to insure excess deposits that you may have.Understand FDIC limits.Use bank networks to maximize coverage.Open accounts with different ownership categories.Open accounts at several banks.Consider brokerage accounts.Deposit excess funds at a credit union.

How much bank balance is considered rich

Someone who has $1 million in liquid assets, for instance, is usually considered to be a high net worth (HNW) individual. You might need $5 million to $10 million to qualify as having a very high net worth while it may take $30 million or more to be considered ultra-high net worth.

How do I insure 2 millions in the bank

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

How much money can I deposit in the bank without being reported

Banks must report cash deposits totaling $10,000 or more

When banks receive cash deposits of more than $10,000, they're required to report it by electronically filing a Currency Transaction Report (CTR). This federal requirement is outlined in the Bank Secrecy Act (BSA).

How can I insure more than 250k in bank

Here are four ways you may be able to insure more than $250,000 in deposits:Open accounts at more than one institution. This strategy works as long as the two institutions are distinct.Open accounts in different ownership categories.Use a network.Open a brokerage deposit account.

How much money can you have in your bank account without being taxed

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

How much money can you put in the bank without getting in trouble

Does a Bank Report Large Cash Deposits Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

Is it safe to keep large amounts of money in the bank

Is it safe to have a lot of money in your bank account You should never have more money in your bank account that can be covered by the FDIC. You can spread your money into different accounts or banks to ensure that all of your money is secured so that you can recover it in the event a bank fails or collapses.

Do millionaires keep their money in a bank account

High net worth investors typically keep millions of dollars or even tens of millions in cash in their bank accounts to cover bills and unexpected expenses. Their balances are often way above the $250,000 FDIC insured limit.

How many people have $3,000,000 in savings

1,821,745 Households in the United States Have Investment Portfolios Worth $3,000,000 or More.

Where do millionaires keep their money insured

Millionaires don't worry about FDIC insurance. Their money is held in their name and not the name of the custodial private bank. Other millionaires have safe deposit boxes full of cash denominated in many different currencies.

Is it safe to have a million dollars in one bank

FDIC insurance covers a maximum of $250,000 per depositor, per institution. That means if the bank fails, and can no longer return customer deposits, the FDIC will make up any loss to the depositors. It also means that to be fully covered, the $1 million would have to be evenly split between four different banks.

How much money can I take out of the bank without being flagged

Thanks to the Bank Secrecy Act, financial institutions are required to report withdrawals of $10,000 or more to the federal government. Banks are also trained to look for customers who may be trying to skirt the $10,000 threshold.

How much money can you have in your savings account without being taxed

Savings account interest is taxed as income by the federal government. Interest earnings of more than $10 are reported to the IRS and to you by the bank or other institution where the money is deposited using a 1099-INT form.

How do banks insure millionaires

Millionaires can insure their money by depositing funds in FDIC-insured accounts, NCUA-insured accounts, through IntraFi Network Deposits, or through cash management accounts. They may also allocate some of their cash to low-risk investments, such as Treasury securities or government bonds.

Does FDIC cover $500000 on a joint account

Each co-owner of a joint account is insured up to $250,000 for the combined amount of his or her interests in all joint accounts at the same IDI.

How much money can you put in the bank without being suspicious

The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however. The report is done simply to help prevent fraud and money laundering.

How much money can you put in the bank without reporting it to the IRS

$10,000

A person may voluntarily file Form 8300 to report a suspicious transaction below $10,000. In this situation, the person doesn't let the customer know about the report. The law prohibits a person from informing a payer that it marked the suspicious transaction box on the Form 8300.

How much money can you put in the bank without being flagged

Banks must report cash deposits totaling $10,000 or more

When banks receive cash deposits of more than $10,000, they're required to report it by electronically filing a Currency Transaction Report (CTR). This federal requirement is outlined in the Bank Secrecy Act (BSA).

How much money can I have in my bank account without being reported

Banks are required to report cash into deposit accounts equal to or in excess of $10,000 within 15 days of acquiring it. The IRS requires banks to do this to prevent illegal activity, like money laundering, and to curtail funds from supporting things like terrorism and drug trafficking.

Do any banks insure more than 250 000

First, you can qualify for coverage of more than $250,000 if you have funds in different ownership categories at an FDIC-insured bank, according to the agency's website.